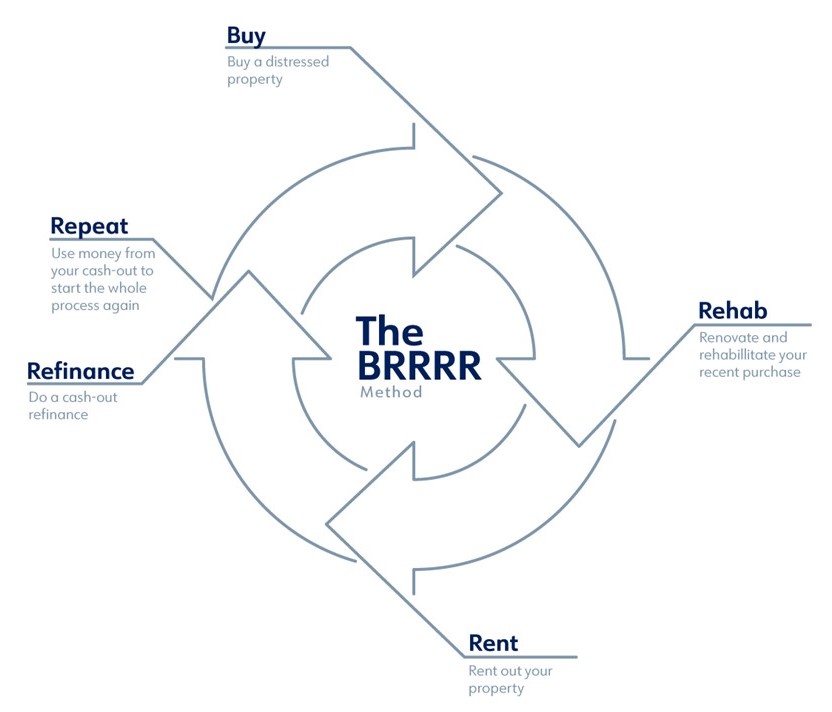

BRRRR strategy can provide passive income and a revolving method for purchasing and owning rental property. The method works through the following steps: Buy a property: The property you purchase should be a distressed property that needs some work to get […]

read more

Refinancing

Understanding BRRRR for Real Estate Investing

Is It Too Soon to Refinance My Mortgage Loan?

Mortgage rates have fallen a great deal this year and millions of homeowners as well as investors might benefit by refinancing even if they bought a home just last year. Mortgage rates moved lower last week even though the broader bond market […]

read more

read more

WHAT IS A MORTGAGE REFINANCE?

As their names suggest, mortgage refinance options award borrowers the unique opportunity to adjust their previously agreed upon loan obligations. In other words, a proper refinance could give qualifying borrowers the chance to change their credit terms and conditions. In […]

read more

read more

How Many Loans Will the Fannie Mae and Freddie Mac Lend to Investors?

In 2009, Fannie Mae and Freddie Mac rolled back the mortgage rule that prevented real estate investors from financing more than 4 properties per borrower. At the time, investors were limited to 4 properties financed, which included their primary residence. […]

read more

read more

Non-Seasoned Cash-Out Refinance Program

DELAYED FINANCING EXCEPTION Borrowers who purchased an Investment Property or Second Home within the past SIX months are eligible for a cash-out refinance. The new loan amount can be no more than the actual documented amount of the borrower’s initial […]

read more

read more

Refinancing

Refinancing Details The majority of this website and it’s content is geared towards purchase loans mainly because the home buying process is the similar to that of a refinance loan and because buyers typically have more questions than property owners. […]

read more

read more